I have been enjoying following Gail Tverberg's Our Finite World blog - a primary focus for her is the idea that high oil prices are the initial cause of the financial and political and economic problems around the world. High oil prices keep the great recession going, cause the debt and deficit spending problems, reduce innovaetion, and that they could well continue to block any recovery.

She describes a stuttering economy, in which a bit of headway towards economic recovery is made, but the increased activity causes an increase in the price of oil, which then stalls the recovery.

I find some of her arguments a bit undersupported, but many are brilliant. This article is a pretty good summary of her main arguments about the high cost of oil and economic recession and recovery.

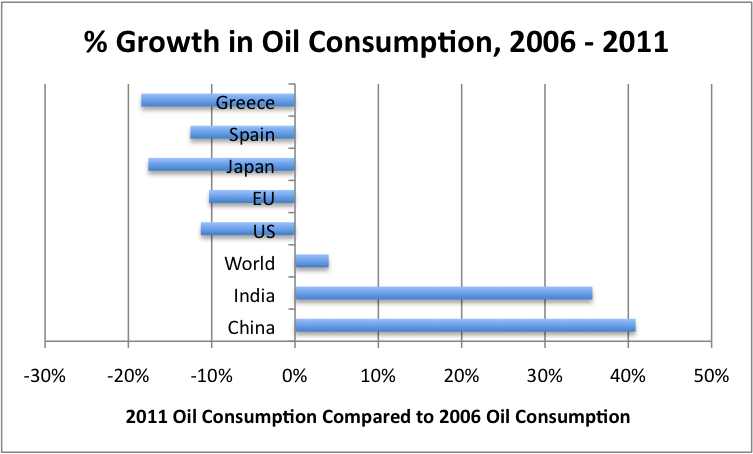

The graph really tells the story.

Ten Reasons Why High Oil Prices are a Problem

Here's a snippet:

8. The impact of high oil prices doesn’t “go away”.

Citizens’ discretionary income is permanently lower. Businesses that close when oil prices rise generally don’t re-open. In some cases, businesses that close may be replaced by companies in China or India, with lower operating costs. These lower operating costs indirectly reflect the fact that the companies use less oil, and the fact that their workers can be paid less, because the workers use less oil. This is a part of the reason why US employment levels remain low, and why we don’t see a big bounce-back in growth after the Great Recession. Figure 4 below shows the big shifts in oil consumption that have taken place.

A major part of the “fix” for high oil prices that does takes place is provided by the government. This takes the place in the form of unemployment benefits, stimulus programs, and artificially low interest rates.

Efficiency changes may provide some mitigation, as older less fuel-efficient cars are replaced with more fuel-efficient cars. Of course, if the more fuel-efficient cars are more expensive, part of the savings to consumers will be lost because of higher monthly payments for the replacement vehicles.

http://ourfiniteworld.com/2013/01/17/ten-reasons-why-high-oil-prices-are-a-problem/

Writing in comment style - that is, fast and informally - she gives a fun analogy here...

These folks don’t seem to understand the idea that oil does far more than what its dollar value would seem to suggest. It really is like another employee, that is able to take on tasks humans can’t handle by themselves. The “oil employees” have now demanded a raise. The total amount produced won’t increase, so it is hard to give “oil employees” a raise, without either reducing the amount other (real) employees are paid, or reducing profits for the company. The one approach that might work, if there is some demand for higher priced products (but not the full amount of demand for the current price of the products) is to close down the least profitable part of the company. (It this were an airline, it might mean canceling flights that often were not completely full, and laying off employees of all types for those flights.) With the scaled-back size of the company, it might be able to go forward, and charge the higher price needed because of the higher energy cost, but to a scaled back group of customers. The net result would be similar to what I suggested in my postHow is an oil shortage like a missing cup of flour? If oil prices are too high, it becomes necessary for “make a smaller batch,” just as the situation that happens if you don’t have enough flour to make a full batch of cookies. This is pretty the situation that happens in recession.